Foreword

When even the supermarkets are sending us personalized offers, people expect at least as much from their employers.

Every year UK businesses spend billions of pounds on benefits.

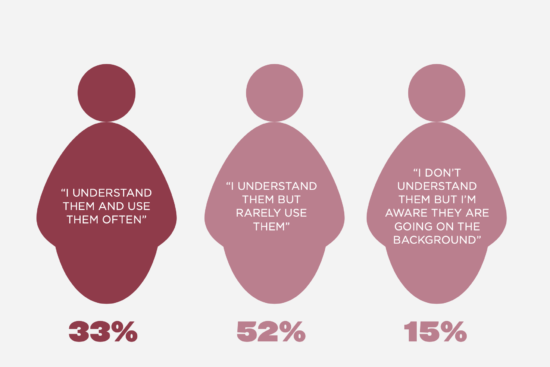

The keyword in there being ‘benefit’… the stuff you spend all that money on to look after your staff! Much to our concern, our research tells us only 1 in 3 employees understands and actually uses their benefits often.

What does this mean? Billions of pounds are being wasted on benefits that fail to resonate, offering little upside to anyone other than the suppliers themselves. We think this has to change, especially when attracting, inspiring, and retaining staff is getting harder.

A benefit isn’t really a benefit unless it is recognized and used by employees; it has to add real value. When we speak to relevant decision-makers, they often express that their employees want more choice and flexibility. They tell us their concern is not always about how much they have to invest, but how they can deliver impact that meets expectations.

It comes down to data. It’s important for employers to really get to know individuals inside the organization. It’s also important for business leaders to grasp which trends exist among demographics in a more general sense.

Organizations need guidance and benchmarks to help them allocate certain clusters of benefits to particular groups of people. Until now, there has been a lot of research into what companies are buying, but limited intel into what matters from the employee perspective. We want to change that.

With more data, decision-makers can offer benefits that really resonate with employees. A one-size-fits-all approach is riddled with risk. The key is to tailor options to increase employee satisfaction and retention.

“If you’re going to spend money on benefits, do it right, in a way that delivers reward people will actually find rewarding.” – Philip Alexander, CEO, People Platform

When benefits selection and administration is outsourced to brokers, the potential risk of missing the mark becomes higher. Do the options add value to the people they are meant for, or are they generic and simply the ‘easy’ option? We always encourage business leaders to analyze their company DNA to make more informed decisions.

Trouble retaining talent? Benefits to the rescue

“Employee benefits help shape the culture of a company and say a lot about its values, and so it’s important that employees know what benefits are offered. Bob’s benefits page makes it really easy for employees to see what benefits they have and what else is available to them.” – Emily Charles, Operations Manager, Improbable

80% of employers say staff retention is a primary concern.

Most employers we surveyed said they struggle with retention.

More than half feel they don’t have control over people leaving.

Around 3 in 4 said they spend a lot of money on addressing these challenges.

72% of employers say benefits are crucial for talent retention, but only a third offer more than the minimum requirement.

Of the benefits decision-makers we surveyed, 74% said they believe benefits also offer the opportunity to save on the overall cost of employment. Our survey also revealed 66% of benefits decision-makers just do the minimum required to meet legal obligations.

Room to improve: missed perk potential

Only 1 in 3 employees makes regular use of their benefits.

“More than half of employees said they understand their benefits, but don’t use them. This suggests the benefits themselves aren’t hitting the mark; either they aren’t relevant or they aren’t easily accessible… or both. Either way, employers are spending money on benefits that are adding little if any value to some staff.” – Dan Benatan, Head of Benefits, HiBob

Employers expect job-hoppers: employees plan to stay

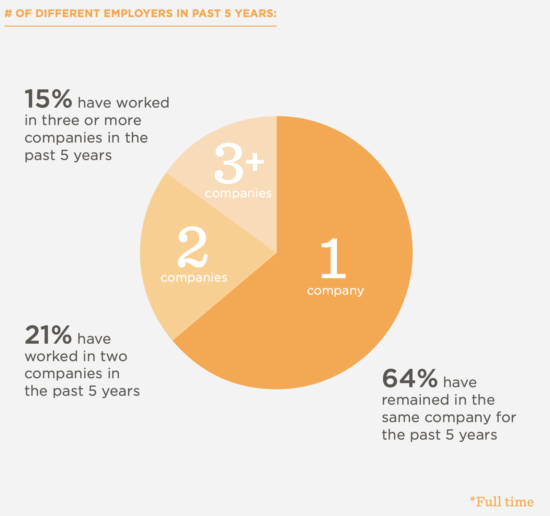

Most HR decision-makers think employees don’t stay long enough to make use of benefits, but employees are prepared to stay put.

Contrary to mainstream views about employees becoming more prone to frequent job-hopping, our survey data reveals that workers are prepared to stick with their employers for many years; their intention is to stay put. More than 84% plan to stay for 2 or more years.

Their recent track record stacks up, too. Almost two-thirds (64%) of employees we surveyed said they had worked for the same employer for the past 5 years.

Benefits: the UK’s big investment

Employers spend between 5% and 9% of their payroll on benefits.

With 21 million* workers in the UK, earning an average of £27,200* a year, this means the annual spend by UK businesses on employee benefits is approximately £40bn. That is a lot of money that needs to be spent effectively.

Employers and workers see things differently: bridging the budget gap

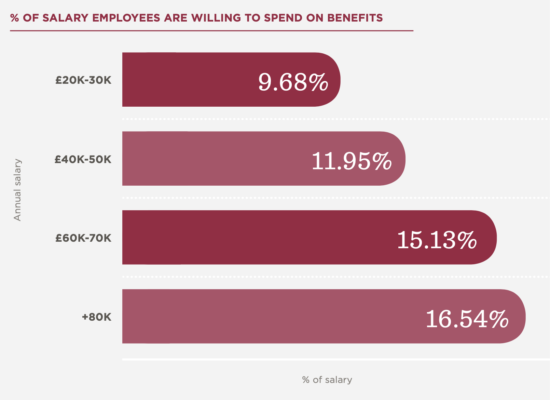

“There is clearly a mismatch between how much employers think workers are willing to spend on benefits, and the amount they actually chose. It goes to show that decisions about which benefits to offer – and how much to spend on them – should be driven by data.” – Dan Benatan, Head of Benefits, HiBob

Employees are willing to give up 11% of their salary to benefits. Employers said 27%.

The higher the income, the more people are prepared to spend on benefits.

Job selection: total package matters in attracting employees

“There is a lot of talk about benefits being a key tool for talent retention, however, it’s important to consider the valuable pull factor they have when it comes to talent attraction as well. Employees clearly weigh this up when considering job options – it’s not all about salary and title!” – Philip Alexander, CEO, People Platform

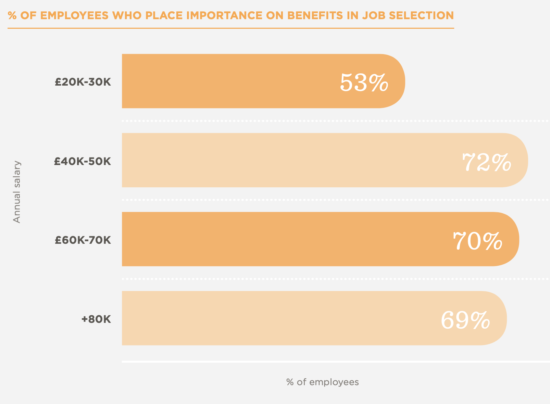

41% of employees said their benefits package was important when choosing their employer.

The importance place on benefits in job selection rises with income.

Younger people (42%) placed more importance on benefits in job

selection than older age groups (37% for age 35-54 and 28% for age

55+). Men regarded it higher (40%) than women did (32%). In terms

of the importance placed on benefits in the assessment of the overall

rewards package, 70% of employees rated them as important.

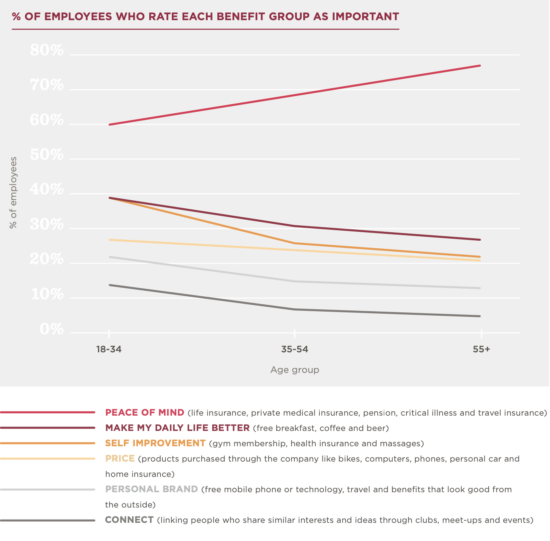

Peace of mind is key: mapping the must-haves

Employees rated ‘Peace of Mind’ benefits as the most important.

Benefits that improve daily life were coined the next most important, followed by self-improvement perks. The importance placed on benefits that offer peace of mind increases with age but decreases for other groups of benefits.

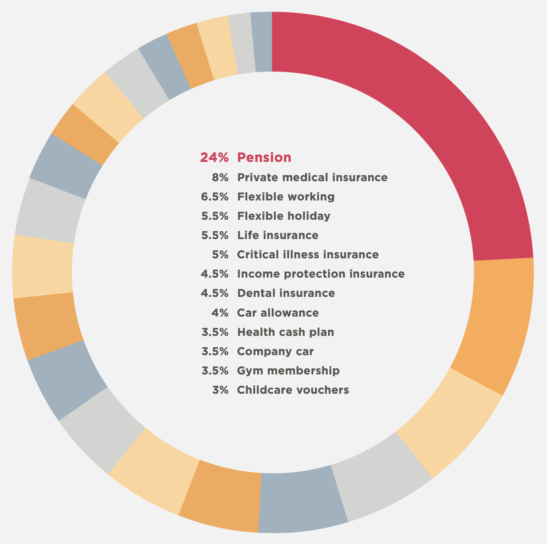

Relative importance: pension before perks

When given a hypothetical budget to allocate towards set benefits, employees spent 24% on pension.

Here’s how they allocated some of the rest:

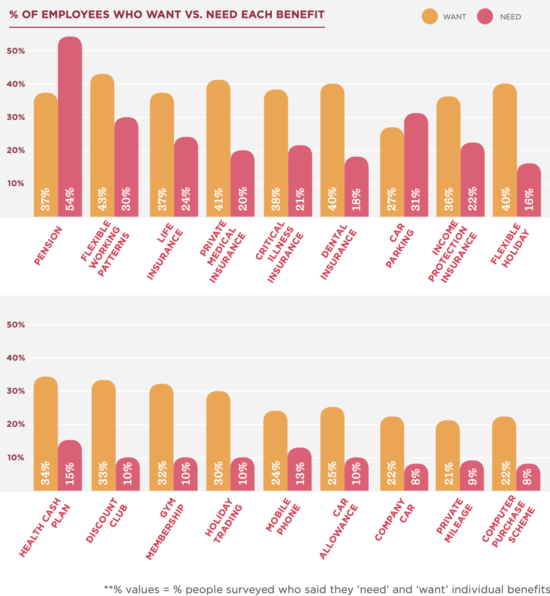

Which will win: the head or the heart?

43% of employees said they want a flexible working and 54% said they need a pension.

When it comes to the benefits employees want, flexible working is the most popular. As for what people feel they need the most, it’s pension. Pension also comes in at number 6 in the list of most wanted benefits and is the only benefit people recognize they need more than they want.

Gender makes little difference to the demand for individual benefits, although men are slightly more interested in the cycle scheme, and women in flexible working. Level of income affects the demand for life insurance and income protection; the more people earn, the more people want to protect it!

**% values = % people surveyed who said they ‘need’ and ‘want’ individual benefits

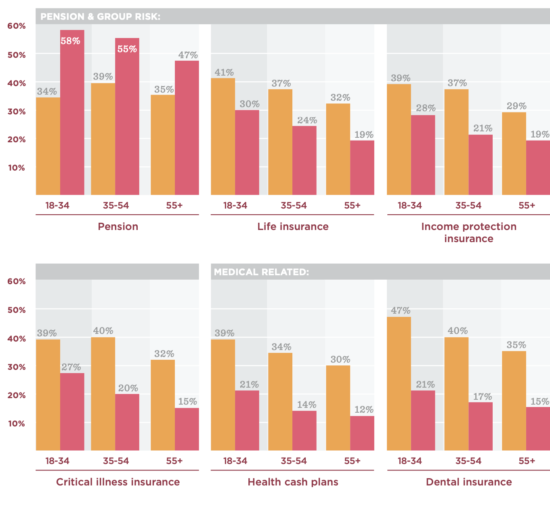

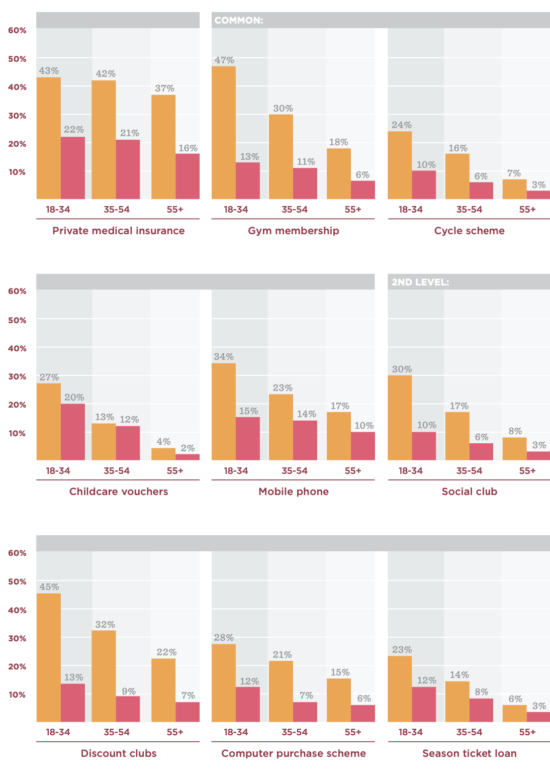

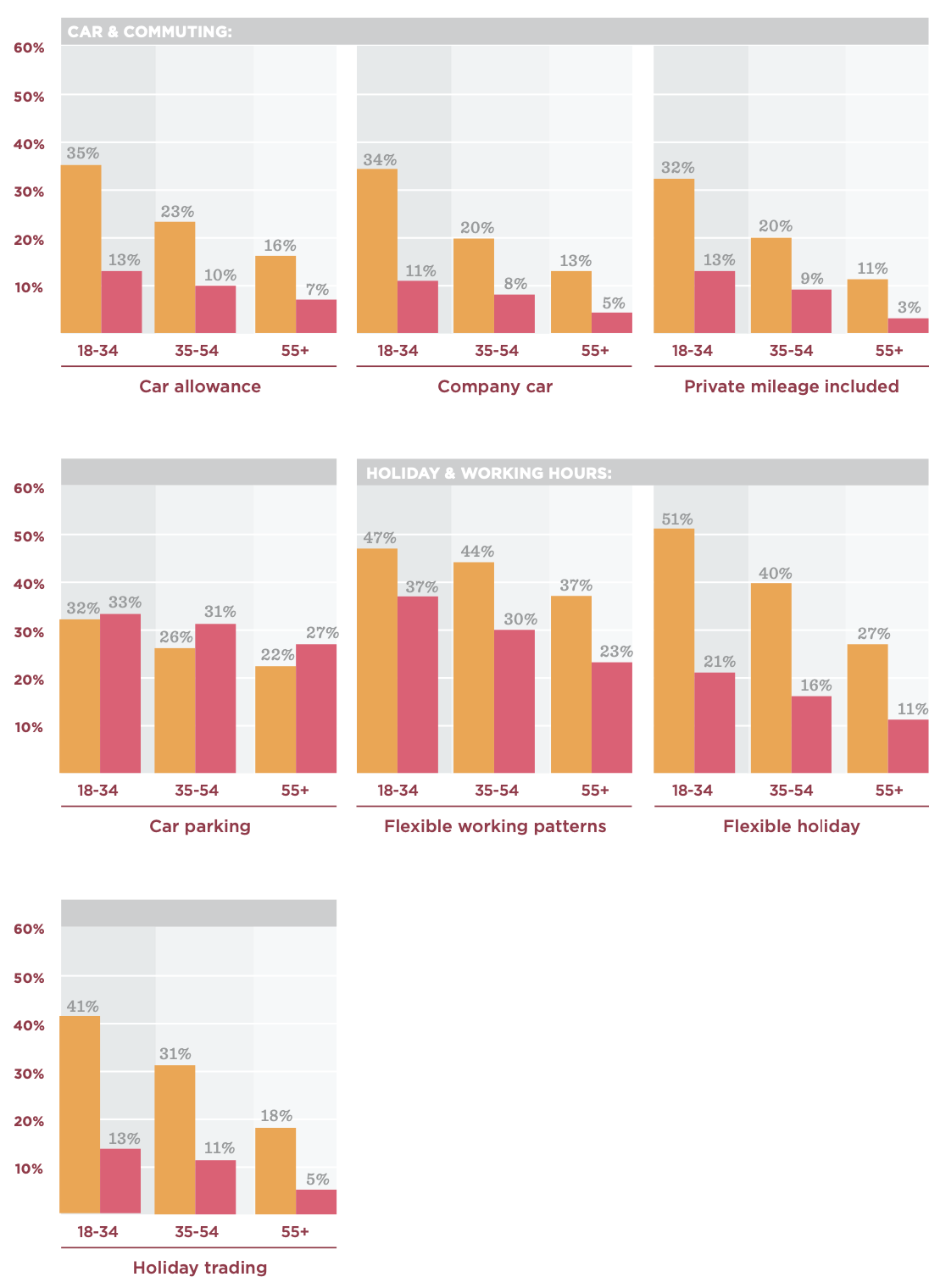

Want or need? Comparing age groups

The need for pension is unanimously high, but younger groups sport a bigger benefits appetite.

Our research suggests that the preference for benefits does vary with age. It’s not overly surprising, considering that stage of life is likely to dictate top priorities, leading people to want and need varying levels of support at different times. However, attitudes across the age groups aren’t always out of sync. While more younger people generally express interest in most 2nd level, common, car & commuting and holiday & working hours perks, the demand for pension & group risk and medical-related benefits comes out high across the board.

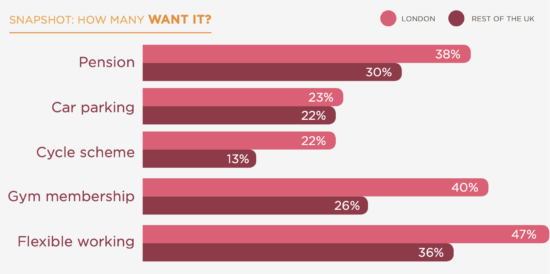

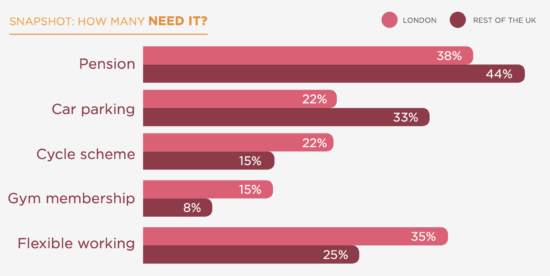

Benefits in the Big Smoke: location affects choice

Considering the difference in pace and lifestyle across regions in the UK, it’s not surprising that priorities vary as well.

Jack McVitie, Chief Executive, LEBC

Where there are obvious differences in commuting patterns geographically, the demand for different travel- related benefits are likely to change too. Businesses should take into consideration where employees live in relation to work, to truly understand their needs.

Dan Benatan, Head of Benefits, HiBob

Londoners said they need pension less than the rest of the UK, but want it more.

Of our UK respondents based outside of London, 44% said they need a pension compared to 38% of Londoners. Those in London rated the need for car parking significantly lower than those outside (22% vs. 33%) but showed an increased desire for a cycle scheme (22% vs. 15%). Londoners also placed more importance on most other benefits, including mobile phone, gym membership, season ticket, computer purchase scheme, and flexible working.

Recommended For Further Reading

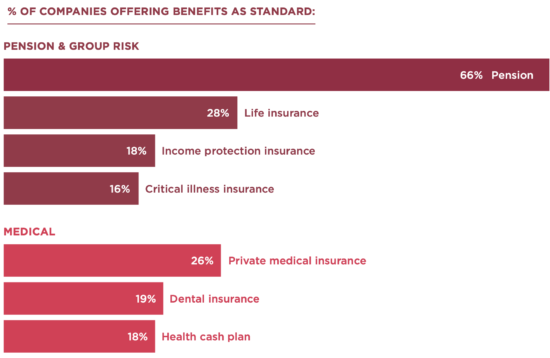

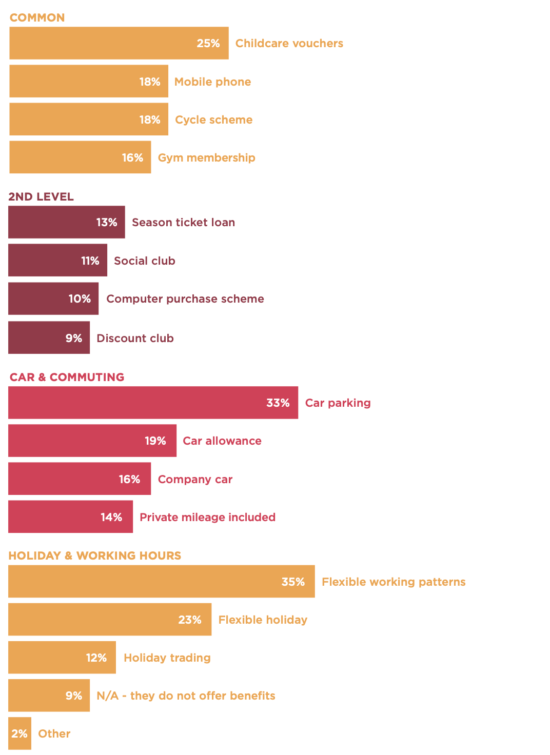

Most common benefits: what employers are offering

“Stage of life, location, and income are just some of the variables that affect which benefits people want and need the most. What works for some won’t necessarily work for others.” – Dan Benatan, Head of Benefits, HiBob

Despite varied preferences across different demographics, 71% of employers offer the same set of benefits to all employees.

Pension is the most frequently provided benefit (>60%) across the employers we surveyed. It’s not surprising, given auto-enrolment legislation makes retirement savings mandatory for eligible workers. The next most popular benefits are flexible working, followed by group risk insurance benefits like life, income protection, and critical illness.

Thank you and stay tuned!

We wanted to say a massive thank you to everyone who took part in this survey. We couldn’t have done it without you. We hope you enjoyed Part 2, which follows our debut chapter, A Fresh Perspective on UK Pensions. We will release Part 3 soon, shining the spotlight on millennials.

Methodology

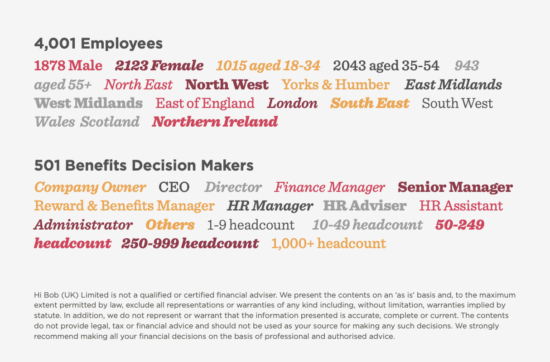

This data has been collected from two online surveys conducted

between the 31st January and 6th February 2017. One questionnaire

was presented to 501 people responsible either solely or partially for

the HR function of their company, while a separate survey was given

to 4001 people employed on permanent contracts in the UK. When we

mention ‘millennials’, we are referring to those currently aged 18-34.

Meet Bob

We’re Bob, a cloud-based HR and benefits platform that transforms the way modern businesses understand, interact with, and manage their talent.

Founded in 2014, we set out to build an HR platform that radically

streamlines the entire administrative workload so that HR is freed up to

focus on today’s number 1 company success factor: employee engagement

and retention.

HIBOB’S TECHNOLOGY FOCUSES ON THREE MAIN AREAS:

CONTROL – Organise all your people data into one central human OS. Our totally connected, paperless, and the robust central platform consolidates the entire HR administration process.

INSIGHT – Make informed, strategic decisions using our powerful

operating system that gives invaluable, real-time insights about your

company.

ENGAGEMENT – Increase employee engagement, drive retention, and build company culture through the use of our smart mobile app, personalized benefits shop, and easy onboarding tools.